It is recommended that you register more than 1 device with DUO, so that if something happens to your primary device, your LAS access is not interrupted.

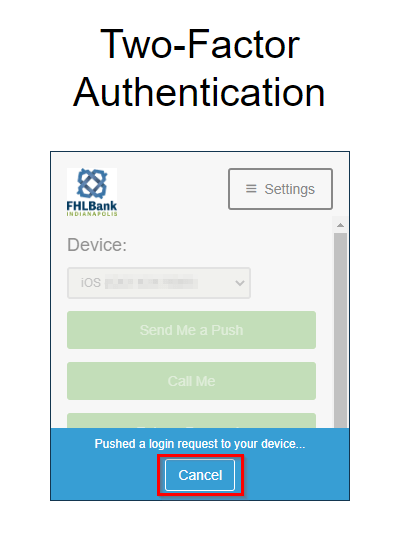

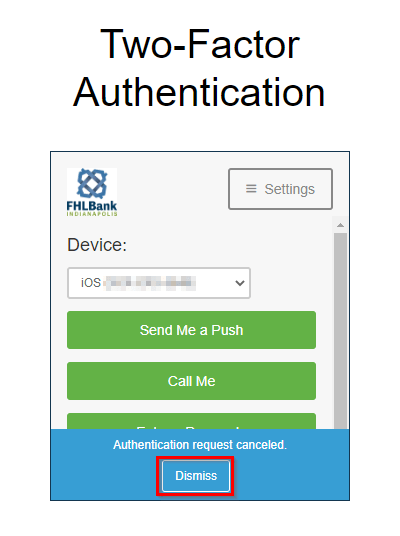

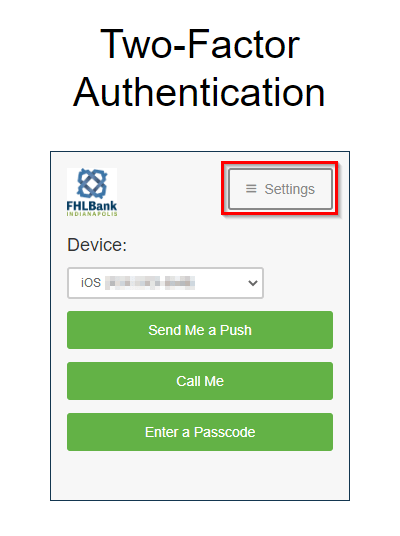

To add an additional device, navigate to LAS, enter your login credentials, and press Enter. If you have DUO setup to automatically send you a push, you will need to hit ‘Cancel’, then ‘Dismiss’.

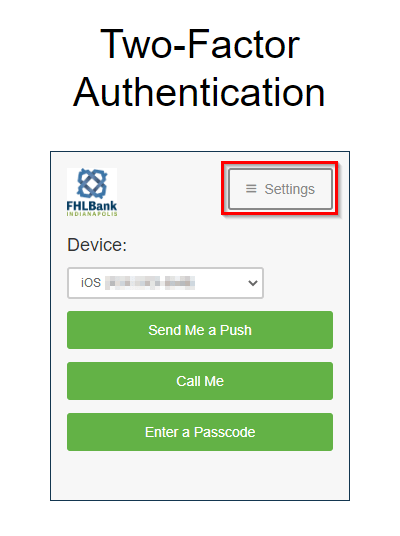

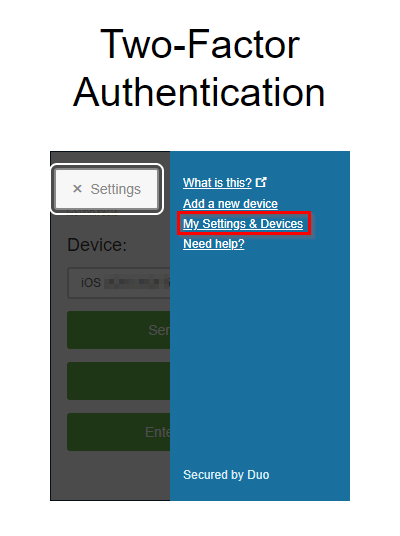

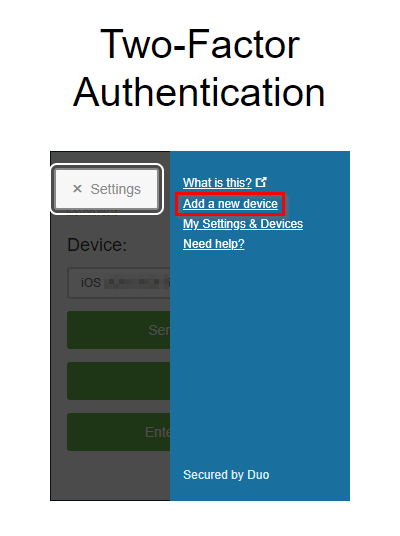

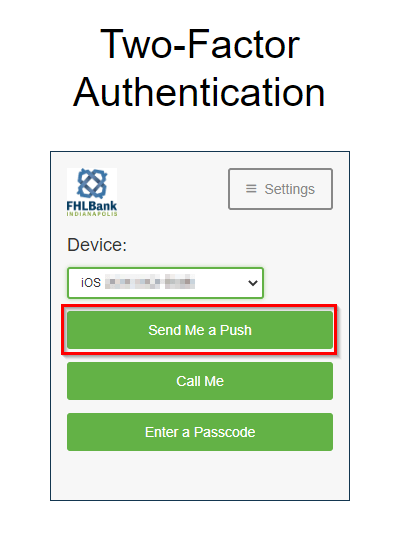

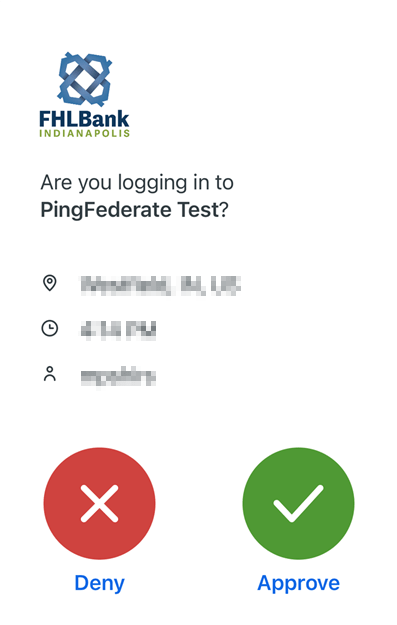

Go to ‘Settings’ and select ‘Add a new device’, then send a DUO request to your existing device.

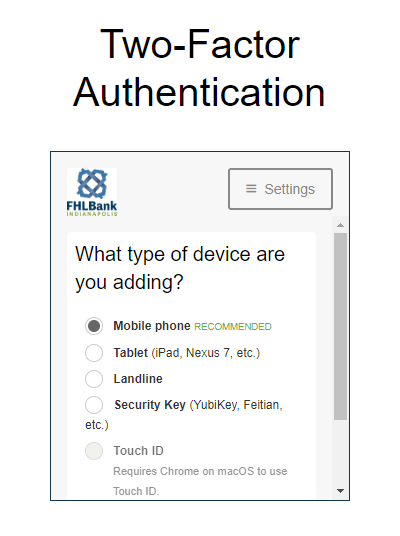

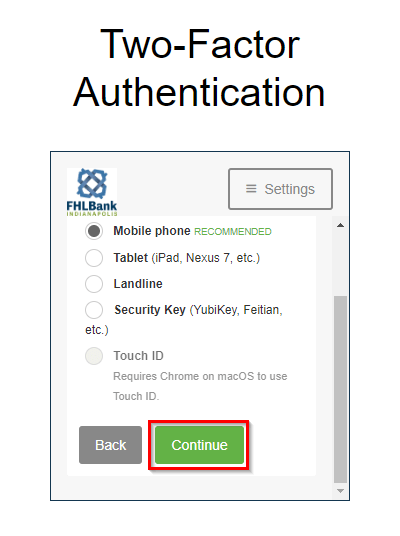

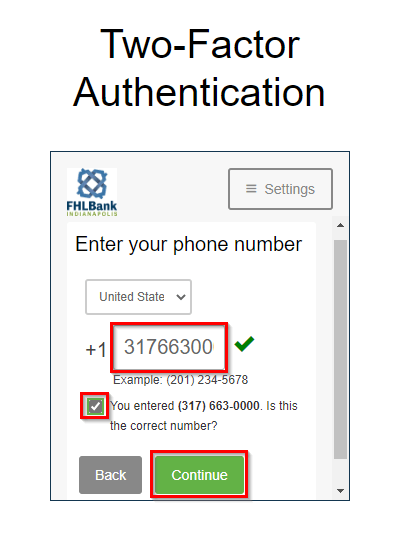

Select device type (Mobile Phone, Landline, etc.), then scroll down to click ‘Continue’. Enter the new phone number, click the checkbox to confirm the number, then click ‘Continue’.

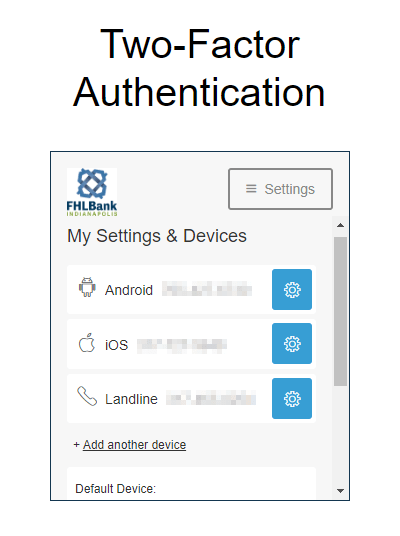

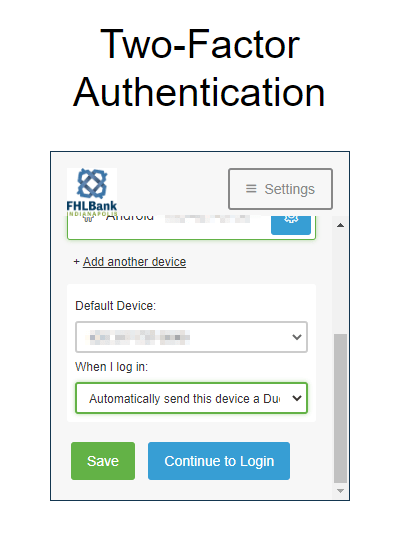

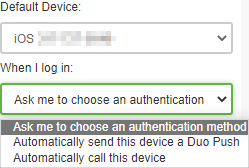

On the ‘My Settings & Devices’ screen, it shows the list of linked devices. You can select a Default Device, and tell it what to do when you log in. You can choose between asking every time, automatically sending a DUO push, or automatically calling you. Click ‘Save’ if you have made any changes.

If you need to change your device settings later, this screen can be accessed via ‘Settings’/’My Settings & Devices’.