How does it work

The Advantage MPP LRA is funded by the Bank at the time the loan is purchased, building an immediate buffer against loan losses and providing an additional layer of credit support after borrower's equity and mortgage insurance. If loan losses are low, funds are returned to the seller over time based on a release scheduled established in the Master Commitment Contract. If loan losses are high and LRA funds are depleted, the Bank will absorb the additional credit losses -- the seller does not replenish the account. No other secondary market program rewards you for selling quality, performing loans.

Valuing the LRA - Advantage MPP

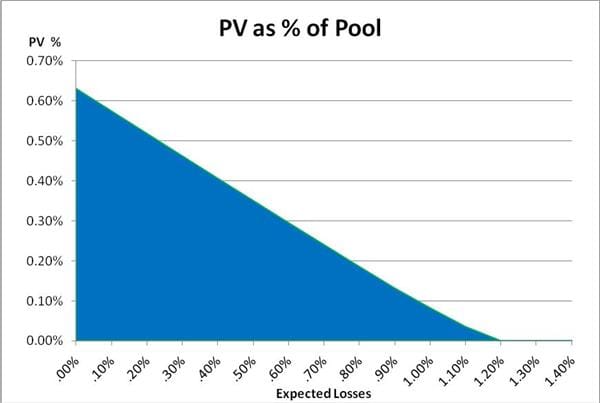

Master commitments issued after November 2010, are under the improved Advantage MPP structure in which the LRA is funded up front. Because the Bank funds the LRA up front, LRA balances and the seller's valuation are no longer subject to prepayment speeds, making LRA valuation simpler and less volatile. To help sellers estimate the potential value of the LRA, we've designed a model that estimates both the net present value and cash flows under various loss scenarios. By determining the present value of the potential future cash flows, the LRA model helps sellers see the value that is in addition to the selling price in order to better compare alternatives and achieve the best loan sale execution.

Below is an example of the potential LRA value under Advantage MPP given an assumed discount rate and loss characteristics. See model (link accessible below) for assumptions and disclosures.

Advantage MPP LRA Valuation (.xlsx file)

LRA